Customs declaring by individuals

In Russia and the Eurasian Economic Union (hereinafter — the EAEU) individuals may use a simplified customs procedure to transfer their personal belongings through customs.

Contents

Simplified customs procedure: what is it?

The simplified procedure means that:

- individuals do not pay customs duties (excluding cases described here);

- individuals do not need to have certificates or licenses for import/export;

- simplified customs clearance (passenger customs declaration or oral declaring);

- it is not necessary to confirm the country of the origin of the belongings.

Personal and non-personal use

Customs authorities examine belongings transferred across the border to find out whether those belongings are for personal use. They take into account the following:

- information provided by the individual orally or in a passenger customs declaration;

- nature and quantity of belongings;

- frequency of border crossing by the individual.

Regardless of the above-mentioned criteria, there is a wide range of goods that cannot be regarded as the belongings for personal use. The EAEU Commission Decree No 107 of Dec 20, 2017 stipulates the List of such goods. No one can import/export those goods under simplified procedure.

The list of the goods not for thee personal use comprises:

- slot machines;

- more than 5 liters of alcohol;

- mowing machines (except lawn mowers), haymaking machines;

- equipment for photographic laboratories;

- dual-purpose products (i.e. civil/military).

There are also certain personal belongings requiring a special permit for importation (for example: radio-electronic devices).

Customs declaring

According to the general rule it is necessary to declare personal belongings transferred across the customs border of the EAEU. There are two forms of customs declarations: oral and written. It depends on belongings nature, their quantity and the way of transportation.

If a person exports the same belongings frequently, it might mean the belongings are exported not for personal use. Quantity of the exported belongings also affects the conclusion of customs officer whether the belongings are for personal use: e.g., in his opinion, it would be unlikely that 20 smartphones could be for personal use.

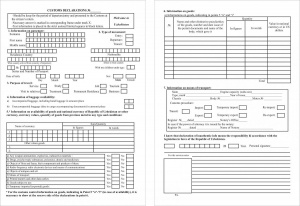

Written declaring

In this case an individual fills a passenger customs declaration (PCD). All customs offices provide persons with special places with samples of PCD as well as blank sheets to be filled.

According to the Article 260 of the EAEU Customs Code, there are certain goods that must be declared in writing:

- accompanied commodities for personal use if a person has got an unaccompanied luggage;

- any goods delivered to individuals by the carriers;

- commodities imported by any means of transport except air, if their total cost exceeds €1,500 and (or) their total weight exceeds 50 kg;

- goods imported by air, if their total cost exceeds €10,000 and (or) the total weight exceeds 50 kg;

- imported (exported) cash and traveler's checks if their customs value exceeds $10,000;

- imported (exported) external and internal securities;

- imported precious metals (gold, silver, platinum, palladium, iridium, rhodium, ruthenium and osmium) in any form as well as gems (pearls, amber, diamonds) if the total customs value of which does not exceed the amount, equivalent to $25,000 (except temporary exported jewelry);

- cultural property;

- exported Russian Federation state awards;

- ozone depleting substances;

- collectibles on mineralogy and paleontology;

- endangered animals, plants as well as products made of them;

- weapons, its main parts, and ammunition;

- imported alcoholic beverages and beer in quantities of 3 to 5 liters per each 18 years old individual;

- drugs and psychotropic medication for personal use as well as precursors of which, accompanied by relevant documents;

- radio-electronic equipment and (or) high-frequency devices for civil use (including built-in devices, e.g. integrated circuits);

- cryptographic devices and (or) special hardware meant for secret information acquisition;

- vehicles, and its main parts;

- indivisible belongings (i.e. belongings consisting of one unit or one set of units) weighing more than 35 kg;

- commodities imported by diplomatic staff workers and their family members for personal use not more than once a year;

- commodities for personal use that were inherited, upon condition that there is documentary confirmation of the fact that these commodities were inherited;

- belongings for personal use imported by diplomatic staff workers and their family members not more than once a year;

- belongings imported by individuals sent to work to a foreign country by state agency not more than once a year;

- belongings imported after temporary exportation and second-hand belongings that are imported by refugees;

- urns with ashes, coffins with the bodies (remains) of the deceased.

If you wish, you may also declare in writing any other belongings which are not included in this list.

Oral declaring

All belongings not included in the list above may be declared orally.

This procedure is supposed to answer customs officer’s questions. The documents confirming the declared information are only provided at the officer’s request. Moving through the green channel is also a form of oral declaring, which assumes absence of belongings needed to be declared in writing.

Belongings declared for personal use (either orally or in the declaration) may not be used in any type of business activity — it would mean that they were transported illegally. |

References